ITR-1, also known as 'Sahaj', is the most commonly used income tax return form in India. Designed for salaried individuals and pensioners with simple income sources, it covers over 70% of individual taxpayers. If you're a salaried person wondering how to file your tax return, this comprehensive guide will walk you through everything you need to know about ITR-1 filing for FY 2024-25.

What is ITR-1 (Sahaj) Form?

ITR-1, commonly called 'Sahaj' (meaning 'simple' in Hindi), is a simplified income tax return form designed for resident individuals with uncomplicated income sources. It's a 4-page form that covers the most common income scenarios for salaried employees, pensioners, and individuals with basic investment income.

The form is designed to be user-friendly and can be completed online within 15-30 minutes if you have all the required documents ready. It automatically calculates your tax liability and determines whether you're eligible for a refund or need to pay additional tax.

Who Can File ITR-1?

Eligibility Criteria

✅ You CAN use ITR-1 if:

- • You are a resident individual (not NRI)

- • Your total income is up to ₹50 lakh

- • You have income from salary or pension

- • You own one house property (self-occupied or let out)

- • You have other sources income (interest, dividend up to ₹5,000)

- • You don't have any business income

- • You are below 60 years (or use appropriate form for senior citizens)

Who Cannot Use ITR-1

❌ You CANNOT use ITR-1 if:

- • You are a director in a company

- • You have capital gains (short-term or long-term)

- • You own more than one house property

- • You have business or professional income

- • You have foreign assets or income

- • You have invested in unlisted equity shares

- • Your total income exceeds ₹50 lakh

- • You need to carry forward any losses

Income Sources Covered in ITR-1

1. Salary Income

- Basic salary, DA, HRA - All regular salary components

- Allowances - Travel, medical, education allowances

- Perquisites - Company car, laptop, phone benefits

- Bonus and incentives - Annual bonus, performance incentives

- Leave encashment - Payment for unused leave

2. House Property Income

- Self-occupied property - No rental income (deemed income: Nil)

- Let-out property - Rental income minus standard deduction (30%) and interest on loan

- Deemed let-out - If you have multiple properties

3. Income from Other Sources

- Bank interest - Savings account, fixed deposits, recurring deposits

- Dividend income - From shares, mutual funds (up to ₹5,000)

- Interest on bonds - Government bonds, corporate bonds

- Income from lottery - Winnings from lottery, crossword puzzles

Documents Required for ITR-1 Filing

Primary Documents

Identity Documents

- • PAN Card

- • Aadhaar Card

- • Bank Account Details

Income Documents

- • Form 16 from Employer

- • Salary Slips (April to March)

- • Form 26AS

Investment and Deduction Documents

- Section 80C investments - PPF, ELSS, Life Insurance, NSC certificates

- Section 80D - Health insurance premium receipts

- Section 80E - Education loan interest certificate

- Section 80G - Donation receipts to approved institutions

- Home loan documents - Interest certificate, principal repayment

Income Proof Documents

- Bank statements - All bank accounts for interest calculation

- Interest certificates - From banks, post office, bonds

- Rent receipts - If claiming HRA exemption

- Property documents - For house property income/loss

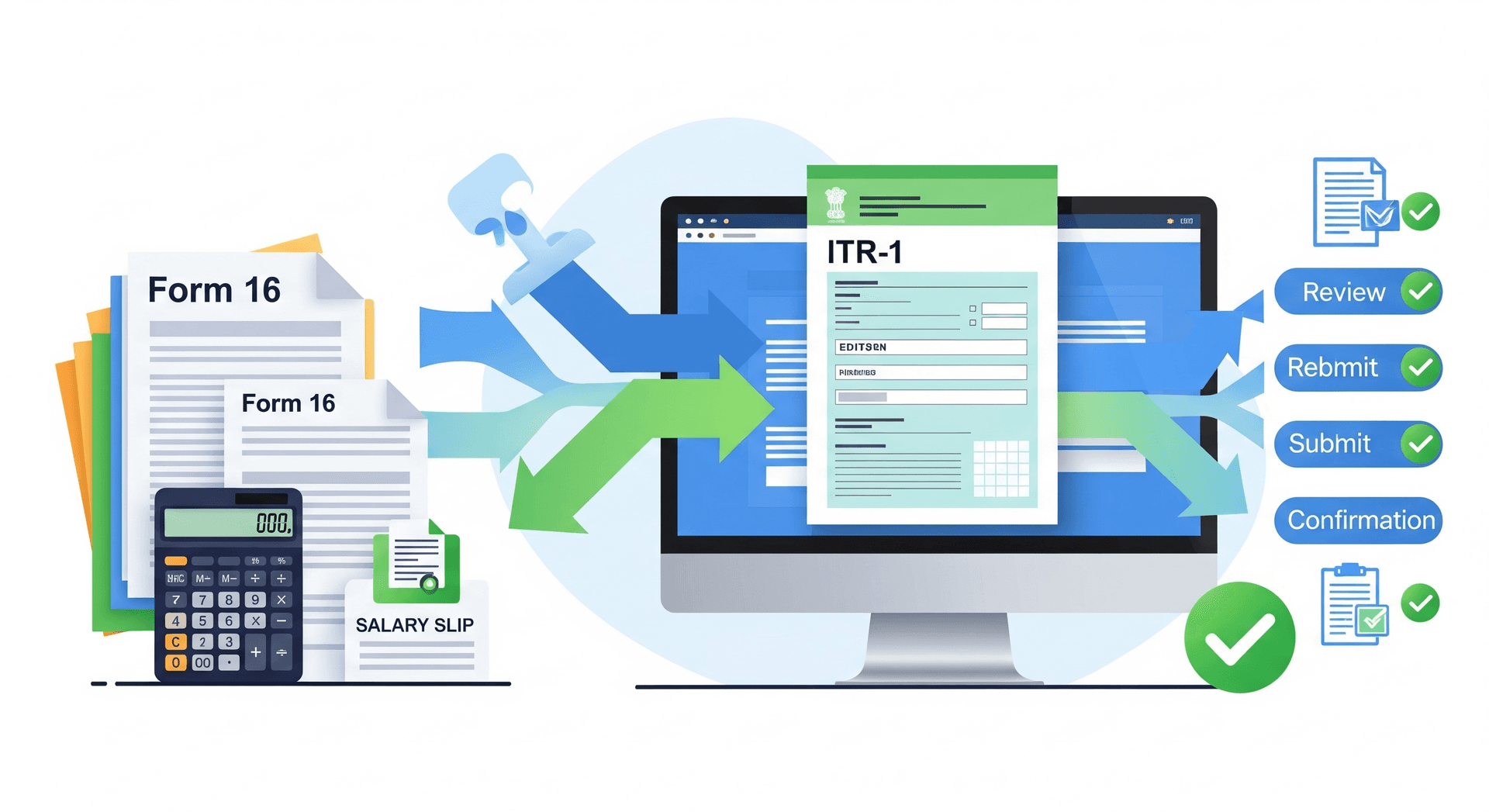

Step-by-Step Guide to File ITR-1 Online

Step 1: Access the Income Tax Portal

- Visit the official income tax e-filing website: incometax.gov.in

- Click on "Login" and enter your PAN as User ID

- Enter your password (create account if first-time user)

- Complete two-factor authentication if enabled

Step 2: Download Pre-filled ITR

- Go to "e-File" menu and select "Income Tax Return"

- Choose "ITR-1" and select Assessment Year "2025-26"

- Download the pre-filled ITR (contains data from Form 26AS)

- Review pre-filled information for accuracy

Step 3: Fill Personal Information

Section A: Personal Information

- • Verify name, PAN, address details

- • Update mobile number and email

- • Select appropriate status (Individual, HUF, etc.)

- • Choose residential status (Resident/NRI)

Step 4: Fill Income Details

Section B: Income Details

- • Enter salary income from Form 16

- • Add house property income (if any)

- • Include income from other sources

- • Verify total gross income calculation

Step 5: Claim Deductions

Section C: Deductions

- • Section 80C: Up to ₹1.5 lakh (PPF, ELSS, Insurance)

- • Section 80D: Health insurance premiums

- • Section 80E: Education loan interest

- • Standard deduction: ₹50,000 (automatic)

Step 6: Calculate Tax and TDS

- Review calculated taxable income

- Verify tax computation based on chosen regime

- Enter TDS details from Form 26AS

- Check if refund is due or tax is payable

Step 7: Verify and Submit

- Preview the complete return

- Validate all information carefully

- Generate and submit XML file

- Download acknowledgment (ITR-V)

Step 8: E-Verify Your Return

- Choose e-verification method (Aadhaar OTP, Net Banking, etc.)

- Complete verification within 30 days

- Receive ITR processing confirmation email

- Download processed ITR for records

Common Mistakes to Avoid

Income Reporting Errors

- Missing TDS entries - Always cross-check with Form 26AS

- Incorrect bank interest - Include all bank accounts

- Wrong HRA calculation - Use correct exemption formula

- Missing perquisites - Include all benefits from employer

Deduction Claim Errors

- Exceeding 80C limit - Maximum ₹1.5 lakh allowed

- Wrong health insurance claims - Check eligibility and limits

- Missing investment proofs - Keep all certificates ready

- Incorrect home loan interest - Use actual certificate amounts

Technical Errors

- Bank account mismatch - Ensure same bank account for refund

- Missing e-verification - Complete within 30 days

- Wrong assessment year - Use AY 2025-26 for FY 2024-25

- Calculation errors - Double-check all computed amounts

Important Dates and Deadlines

| Activity | Due Date | Penalty for Delay |

|---|---|---|

| ITR-1 Filing | July 31, 2025 | ₹5,000 (₹1,000 if income ≤ ₹5L) |

| E-Verification | 30 days from filing | Return deemed invalid |

| Belated Return | December 31, 2025 | ₹5,000 + Interest |

ITR-1 vs Other ITR Forms

| Feature | ITR-1 | ITR-2 | ITR-3 |

|---|---|---|---|

| Income Limit | Up to ₹50L | No limit | No limit |

| Business Income | ❌ Not allowed | ❌ Not allowed | ✅ Allowed |

| Capital Gains | ❌ Not allowed | ✅ Allowed | ✅ Allowed |

| Multiple Properties | ❌ Only one | ✅ Multiple | ✅ Multiple |

Frequently Asked Questions (FAQs)

Who can file ITR-1 (Sahaj) form?

ITR-1 can be filed by resident individuals with total income up to ₹50 lakh from salary, one house property, and other sources like interest. You cannot use ITR-1 if you are a company director or have capital gains.

What documents are required for ITR-1 filing?

Key documents include Form 16, salary slips, bank statements, interest certificates, Form 26AS, Aadhaar card, PAN card, and investment proofs for deductions under Section 80C, 80D, etc.

What is the due date for filing ITR-1?

The due date for filing ITR-1 for FY 2024-25 (AY 2025-26) is July 31, 2025. Late filing attracts a penalty of ₹5,000 (₹1,000 for income up to ₹5 lakh).

Ready to File Your ITR-1?

Skip the hassle! Our expert CA team files your ITR-1 in 24 hours with maximum refund optimization.

✓ CA Certified ✓ Maximum Refund ✓ 24hr Service ✓ Error-Free Filing

Conclusion

ITR-1 (Sahaj) is designed to make tax filing simple for salaried individuals. With proper documentation and understanding of the process, you can complete your tax return in under 30 minutes. The key is to gather all documents beforehand, understand your eligibility, and avoid common mistakes.

Need help filing your ITR-1? Our tax experts at Return Filer specialize in hassle-free ITR filing with maximum refund assurance. Get professional ITR filing assistance today and ensure error-free compliance.